Ira Early Withdrawal Calculator 2025. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year. Your ira savings is always yours when you need it—whether for retirement or emergency funds.

How much of your contribution is deductible, how taxes differ from roth iras, and how early withdrawals work. It is mainly intended for use by u.s.

Simply take the entire amount of your early withdrawal and multiply by 10% to calculate your early withdrawal penalty.

Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year.

Ira Rmd Tables 2025 Bel Melisandra, There could be better ways to pay for an unexpected expense. Ira withdrawal penalties depend on various factors, including account type, account holder’s age and reasons for the withdrawal.

Roth ira early withdrawal calculator ToniiTimotei, Use our ira calculator to see how much your nest egg will grow by the time you reach retirement. The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings.

Roth IRA Withdrawal Rules and Penalties First Finance News, 2025 early retirement account withdrawal tax penalty calculator. The early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost.

Retirement withdrawal calculator Early Retirement, The early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost. Ira withdrawal penalties depend on various factors, including account type, account holder’s age and reasons for the withdrawal.

roth ira early withdrawal Choosing Your Gold IRA, Here is a breakdown of what to expect when taking an. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year.

Rmd Tables For Ira Matttroy, You can withdraw up to $5,000 for birth and adoption expenses. You need to pay income tax on an ira early withdrawal.

Irs Actuarial Tables For Ira Awesome Home, You need to pay income tax on an ira early withdrawal. It is mainly intended for use by u.s.

Roth IRA Calculator, Early withdrawal of earnings can lead to a 10% penalty and income taxes unless it’s a qualified distribution. The early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost.

Important ages for retirement savings, benefits and withdrawals 401k, You can make a withdrawal to pay for expenses associated with disability, terminal illness and death. You can do it, but you'll pay a fairly high penalty.

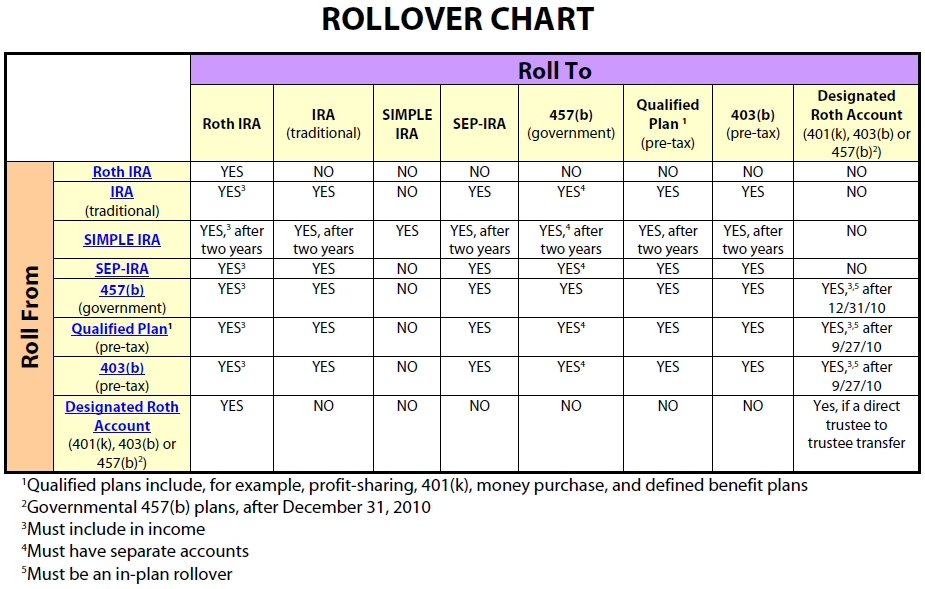

How to Complete a SelfDirected IRA Rollover IRA Financial Group, You can do it, but you'll pay a fairly high penalty. 2025 early retirement account withdrawal tax penalty calculator.