Why Is My Tax Return So Low 2025 With Dependents. Research suggests this may result from barriers to access created by the complexity of filing a state tax return, and the costs of paid tax preparers. The internal revenue service says most taxpayers who file electronically receive their refunds in 21 days or fewer.

The median worker’s wages only increased by around 5.5% in 2025, lower than the general inflation rates. A dependent is a qualifying child or relative who relies on you for financial support.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, A tax deduction reduces your taxable income (the amount of income on which you owe taxes). The form includes pan, tan, salary details,.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, However, families taking certain credits for the. The form includes pan, tan, salary details,.

Why is My Tax Refund So Low 2025, Many financial advisers question the wisdom of getting big income tax refunds. A dependent is a qualifying child or relative who relies on you for financial support.

Why Is My Tax Return So Low? Bitter Truth of 2025 Personal Finance Whizz, 2 totaled $1,395, the irs said in a release. To claim a dependent for tax credits or deductions, the dependent.

Why is my tax refund so low?, The irs says that tax returns can be delayed for the following reasons: Tax topic 151 means your tax return is now under review by the irs.

Why is My Tax Refund So Low ??? YouTube, A tax deduction reduces your taxable income (the amount of income on which you owe taxes). Find details on tax filing requirements with publication 501,.

Why is My Tax Refund So Low? Diversified Tax, Tue, mar 5, 2025, 7:00 am 5 min read. However, families taking certain credits for the.

Why Is My Tax Return So Low Main Reasons for the Decrease, Changes in your personal situation might also affect. However, this year, the limits are much lower.

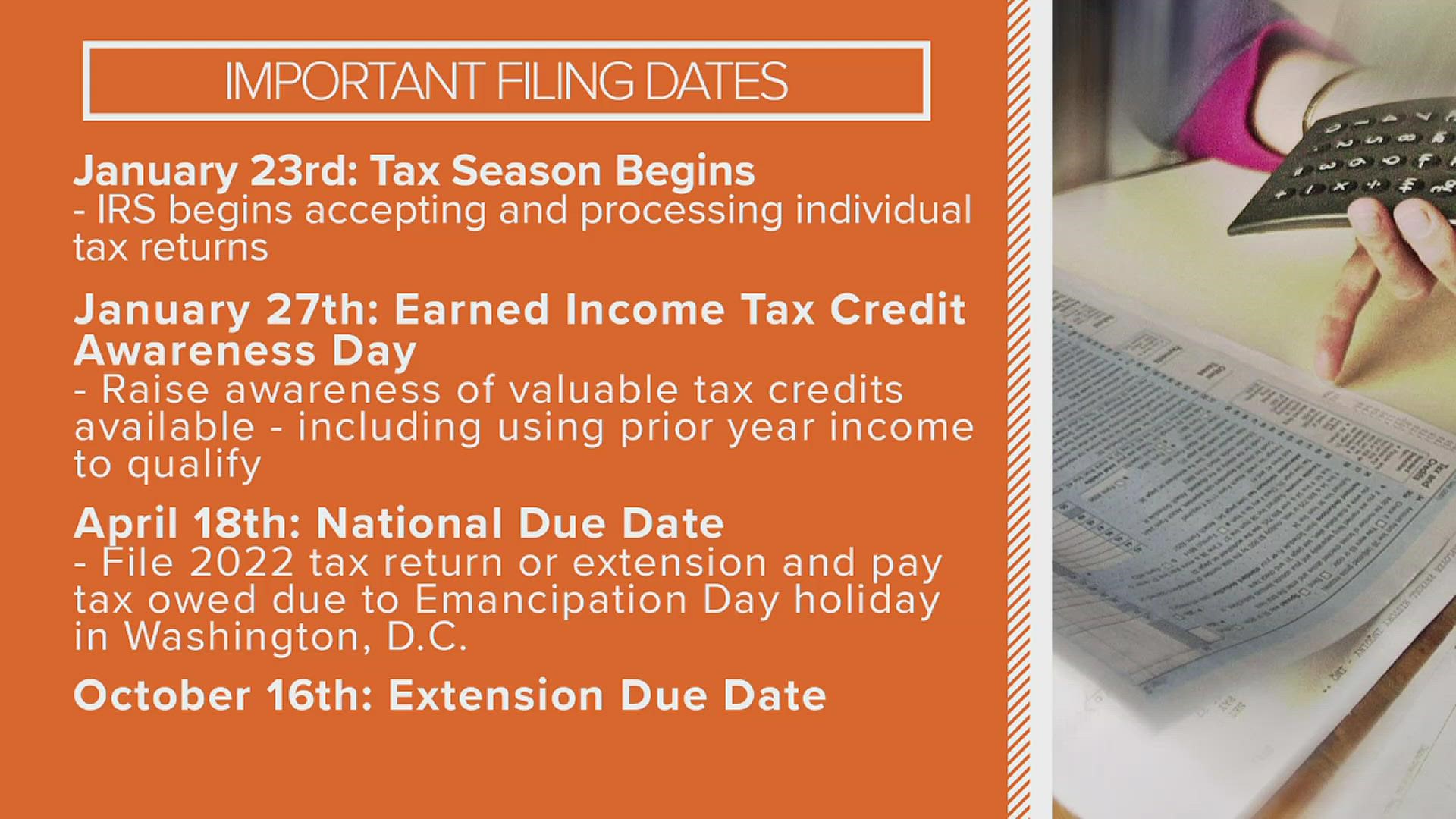

Why is my tax return refund so low this year? What can I claim? And why, Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2025 tax time guide series to help. Choosing the filing status that best matches your situation can lower your taxes and increase your refund.;

Why is My Tax Refund So Low Compared to Previous Years?, Find details on tax filing requirements with publication 501,. However, this year, the limits are much lower.